Posted by: Lena Larsen

Did you know that you can buy a home with ZERO down payment?? If a home purchase is your goal this year but you aren’t able to save up enough of a down payment, you may qualify for a low or zero down payment mortgage. One of our Lenders is offering a great zero down program.

What is a Flex-Down Mortgage?

A Flex-Down Mortgage is a mortgage product that has a flexible down

payment amount. There is still a down-payment required, but it will vary

based on the property value.

- For a property valued under than or equal to $500,000, 5% down payment is required (sources available below)

- For a property valued at greater than $500,000 and less than $1 million –5% down payment is required up to $500,000 with an additional 10% down payment on the portion of the home value above $500,000.

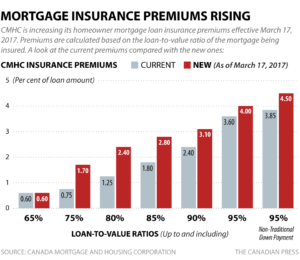

Flex-down mortgages can only be on first mortgages, not second or third or used in refinance situations. As noted above, the total property value has to be less than $1 million. This type of mortgage will also have insurance included with it—the premium will be lesser of the premium as a % of the total new loan amount or the premium as a % of the top-up portion additional loan based on the rates at that time.

Those that choose to go with this type of mortgage product will have to meet requirements, just like any other mortgage. There are a few specifications with this product:

- You must show that you have standard income and employment verification papers

- A credit score of 650 or higher is highly recommended

- You must have no previous bankruptcies

- Some lenders may still require you to have some of the down payment from your own resources

Those considering this type of mortgage are recommended to have very little debt and be able to accommodate the additional cost of higher mortgage insurance (due to the higher risk to the lender on this type of mortgage). Typically, the insurance premium would be 0.2% higher on a flex down mortgage.

How it Works

You can borrow your 5% payment from a Line of Credit or even a credit

card. This can then be used for your down payment. You have to disclose

this to the Insurer and it will be on the application that goes to the

Lender.

This is perfect for someone just getting into a new high paying job or for someone who is renting and can afford higher monthly payments but would take forever to save up the 5% down payment. This type of mortgage product can be an excellent option if you don’t quite have enough for the down payment. Are you interested in learning more about this mortgage product? Contact a Dominion Lending Centres mortgage professional who can show you how a Flex mortgage can make the home of your dreams happen sooner than you think!

Geoff Lee

Dominion Lending Centres – Accredited Mortgage Professional

Geoff is part of DLC GLM Mortgage Group based in Vancouver, BC.

Mortgage Step-by-step

Mortgage Step-by-step Required Documents

Required Documents Apply for a Mortgage

Apply for a Mortgage Understanding Your Credit

Understanding Your Credit Canadian Mortgage Insurers

Canadian Mortgage Insurers